Merging Nonprofit Organizations: What Nonprofit Leaders Need to Know

It’s not every day that two nonprofits merge.

But when they do, the merger process can either be fraught with anxiety or led with clarity and compassion.

To help those considering a nonprofit merger, I called up my former client and now friend, Karen Carloni.

Karen orchestrated the very successful merger of her nonprofit organization with a larger nonprofit.

I asked Karen to share more about her experience to help other nonprofit leaders considering a merger.

Note that evaluating and leading any nonprofit merger conversations is squarely within the role of the executive director in close partnership with the board of directors.

In three sentences, what is the most important thing for nonprofit leaders considering a merger to know?

The most important element of a successful nonprofit merger is clarity.

You need a clear and specific reason for considering the merger, such as financial sustainability, succession planning, or program expansion. Once you start exploring a potential merger, you need to be clear with your board and staff about the rationale, process, timeline, and individual roles.

Let’s cover the basics: Can you merge two nonprofit organizations?

Yes, two nonprofit organizations can merge (and there are other strategic alliances that are not quite mergers but accomplish similar things).

An important thing to recognize is that in a merger of two nonprofits, neither organization “buys” the other. Nonprofit mergers can look different ways. Two nonprofits could join together as a new organization. One organization could acquire the other and take on all its assets and liabilities. One organization could dissolve, and another nonprofit could take on certain programs or have a parent-subsidiary relationship.

Why do nonprofit organizations merge?

Commonly, nonprofit organizations merge for sustainability. By merging, they can reduce overhead and share resources. Sometimes in a particular sector, they may have overlapping missions with competitors, and it makes sense to merge for that reason.

A second common reason is succession planning. If one organization anticipates a leadership change they can consider managing succession through a merger.

A third common reason for a nonprofit merger is recognizing that two organizations have complementary missions or the same vision in different geographies. A merger makes sense in that case for program or territory expansion.

How do you merge two nonprofits? Can you walk us through the process?

In our case, I would say it was a little bit of a “DIY or Mergers for Dummies” process.

We had 2 major reasons to pursue a merger. The first was sustainability and the second was increasing the array of services for our clients.

Our sector was seeing a lot of change and competition from private equity-backed competitors with huge budgets to advertise and attract both clients and staff and there was a demand for adding service types that we did not have the staff or financial bandwidth to add. Information in our market suggested that the scale an organization needed to be able to sustain itself in the future was $100 million. Our clients needed full-scale behavioral health, substance abuse, and primary care services. Basically, a one-stop shop.

We decided what the competencies were for organizations we would be interested in exploring for merger and targeted a few options. We were looking for a financially healthy partner with an outpatient clinic and at least a plan to integrate primary care services. We were open-minded about the model of care.

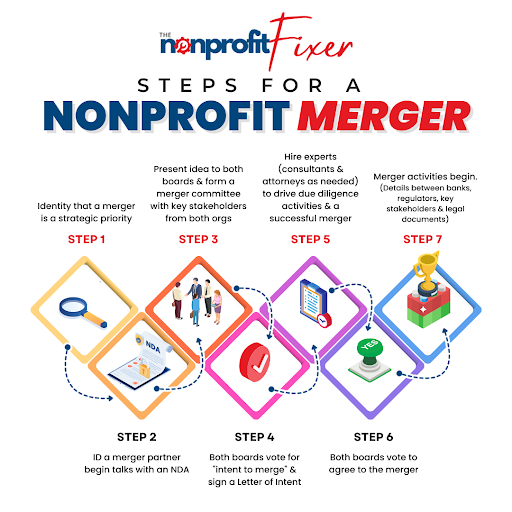

Here are the steps we took in our nonprofit merger:

We identified merger or affiliation as a strategic priority for our future sustainability. The executive director was given the authority to make overtures to possible partners and have exploratory discussions.

Once a potential organization was identified and there was some interest we signed a non-disclosure agreement and began to explore what that would look like. We walked through service line assessments and a high-level discussion about synergies and differences. In our case, we chose to co-present the findings of these discussions with both boards.

We created a merger committee composed of members of both boards and both executive directors and came back with a comparative analysis—financial, HR handbooks, technology systems, properties, programs, etc. These were at a fairly high level. The merger committee prepared a report to both full boards. We presented together to both boards and separately.

The boards voted on an “Intent To Merge” and both organizations signed a LOI. From here we engaged a merger consultant from OPEN MINDS and an attorney to help with financial due diligence.

We conducted due diligence.

A vote was taken to agree to the merger.

Meger activities took place. t took about a year and a half from the initial conversation to the final merger. There were some hold-ups related to the banks, accrediting bodies, and program licensing. Legally there is a Merger Agreement and Articles of Merger.

What due diligence is required for a nonprofit merger?

Due diligence in a nonprofit merger is about a complete disclosure of assets, liabilities, and any potential legal concerns. This includes reviewing all of the following for both nonprofit organizations:

Board By-Laws

Articles of Incorporation

Organizational Charts

Copies of all MOUs, contracts, leases, or agreements.

List of all officers of the company and board members.

Copies of all board minutes - 5 years.

Tax Documents - 990’s (3 years), Tax exemption letter, Unrelated business income

Insurance Documents

Personnel docs - contractor agreements, vendor agreements, policies, list of consultants, compensation plan, etc.

Audited financial statement and management letter - 3 years, all assets, all liabilities, all grant agreements.

Capital Real Estate - leases, deeds, zoning permits.

Licenses, Accreditations, Provider Agreements with state or county entities

Statement of threatened or pending litigation, description of same, and outcomes for the last 3 years.

Banking information

List of all regulatory bodies the organization may be subject to.

What are some of the biggest difficulties in nonprofit mergers? Where do things most often go wrong?

There is a need for trust and transparency throughout the nonprofit merger process and a willingness to embrace change on behalf of the mission.

Mergers often go wrong if one organization feels that there is a cultural mismatch that cannot be overcome or one of the organizations has such serious problems, financial or reputational, that the other organization does not have the resources or bandwidth to manage them. Another issue is if there are founding board members or founding executive directors involved it can be difficult for them to contend with feelings of losing their legacy.

Managing fears and figuring out the final organizational chart are big hurdles.

“Managing fears and figuring out the final organizational chart are big hurdles. ”

Doing a lot of check-ins with key staff is critical. Understanding and empathizing with their concerns is vital. In our case, I had a few respected mid-managers leave in fear of their jobs despite assurances that their jobs were not being eliminated. Post-merger some expressed interest in returning to the organization and were given open roles to apply to.

Knowing what to tell staff and when is critical.

“Knowing what to tell staff and when is critical.”

There are competing ideas on this. Some feel that staff should not know until the ink is dry but key managers will be involved in integration planning and, depending on the size of the organization and the culture, this is a judgment call.

I learned early on in my career that my organization was a small town within a small town. We operated in three semi-rural counties where there were no secrets. We decided to be transparent as soon as the LOI was signed. We chose to immediately begin helping the organizations get to know each other with a monthly joint newsletter introducing programs, staff, etc.

That might not be the way forward for everyone but we learned that no matter how transparent we were there was worry that we weren’t telling everyone everything.

The other area that I would be careful of is “surveying” staff without defining how you will use the results. If the results will be used only to inform the leadership and board, say so. Some staff interpreted a survey about the merger as an opportunity to democratically vote on whether that would go forward. We had to do a lot of education so that staff understood the role of the board of directors and the executive directors.

What are the benefits of a nonprofit merger?

The benefits of a nonprofit merger are vast: financial and operational efficiency, greater impact that can be demonstrated to funding sources, an enhanced bench of talent and expertise, larger program scope, and greater visibility are just a few.

What is the role of a consultant in a nonprofit merger?

There are a variety of consulting roles in a nonprofit merger.

You can engage a consultant to advise you on a high-level organizational and market assessment as a green light to explore the possibility or to find prospects.

You can engage a consultant in a tactical role such as crafting an integration plan, and advising on the new organizational chart, brand or naming strategy, marketing/communications strategy, or even cultural alignment.

You will also need an outside consultant for financial due diligence. Both organizations will need attorneys. Some steps can be done internally depending on the expertise within each organization.

Can a nonprofit and a for-profit merge?

A merger between a non-profit and a for-profit is possible, but there are tax consequences.

If the surviving entity will be the “for profit” they must purchase the assets of the nonprofit. If the surviving entity will be the nonprofit then the exempt status must be maintained by looking at excess unrelated business taxable income, political activities, etc. A third option is for the two organizations to create a third umbrella organization and the for-profit and nonprofit operate under this umbrella.

What tools have you used for nonprofit mergers, such as a due diligence checklist, a letter of intent, or a formal agreement?

A great book to guide the process is “The NonProfit Mergers Workbook” by La Piana. We also leaned heavily on tools provided by our consultant. National and State Non-profit associations offer tools as well.

About Our Expert, Karen Caroloni

Karen Carloni, LCPC, Executive Vice President of OPEN MINDS Market Intelligence. Karen is the former CEO of SMCN and COO of Cornerstone Montgomery. Her experience is in 25 years of serving the community in nonprofit behavioral health. Karen now oversees executive education and market intelligence content to healthcare companies serving vulnerable populations and serves on consulting projects in strategic planning, workforce development and M&A. Find her here.

Looking for more information about nonprofit mergers?

I’ve shared my own thoughts about mergers in my previous article, When and Why Should Nonprofits Merge—including digging into implications for branding and fundraising.

I also coach nonprofit executive directors one on one and in my group coaching program. My clients have found that coaching is especially valuable when navigating leadership challenges and transitions. You can check out my executive leadership coaching programs and schedule a free discovery call to learn more.